In The Wealth of Nations, Adam Smith outlined a foundational economic framework that shaped the last two centuries of capitalist thought. He broke value creation down into three core components: wages (earned by labor), profits (earned by capital), and rents (earned by landowners). For the industrial age, it was both elegant and sufficient.

But we are no longer living in that world.

We’ve entered a new era—an era of AI, platforms, and digital value networks. And in this new world, the Smithian triad is no longer enough to explain how value is truly created, distributed, and captured. At MUSE, we believe it’s time to redefine what drives value in the 21st century.

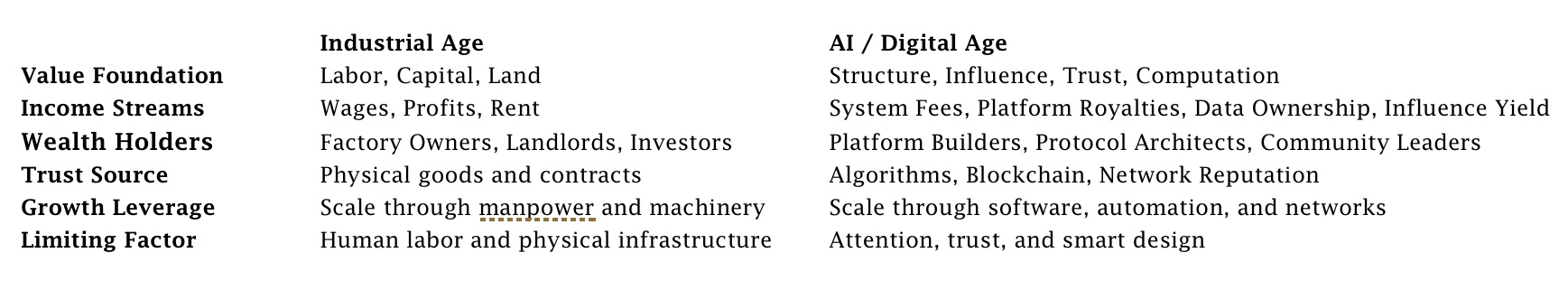

A Tale of Two Eras: Industrial vs. AI

Let’s pause for a moment to compare the two paradigms:

Each Era Has Its Strengths

It’s easy to assume the new always wins—but that would be unfair to the past. The Industrial Era built the infrastructure for modern life. Its strengths were:

- Predictability: Clear input/output models based on effort.

- Productivity: Mechanized tools increased output per worker.

- Scalability: Global trade, supply chains, and mass production.

Meanwhile, the AI Era brings entirely different advantages:

- Exponential Leverage: One well-designed algorithm can replace thousands of hours of labor.

- Decentralized Power: Open-source code, token economies, and permissionless systems redefine ownership.

- Infinite Scale: Platforms scale without physical boundaries or proportional cost increases.

- Trust through Technology: Blockchain replaces paperwork; protocols replace institutions.

Each system is a reflection of its time. But where the Industrial Age rewarded effort and ownership, the AI Era rewards architecture and influence.

The Shift: From Labor to Leverage

In the industrial era, labor was the great equalizer. If two people worked the same number of hours under similar conditions, their output was considered of equal value. The factory system thrived on this logic. Wages were tied to effort. Capital was rewarded for risk. Landowners benefited from scarcity.

But fast-forward to today’s AI-powered, hyper-connected economy, and that equation starts to break down.

Now, the real wealth is being created by those who design the flow of value, not those participating in it. The coder who builds the protocol. The strategist who structures the network. The brand that commands trust.

In this world, value is less about “how much you work” and more about “what you control, who you empower, and what system you set in motion.”

MUSE: A Case Study in Structural Value

MUSE isn’t just another marketplace—it’s a platform that redefines how value is assigned to luxury assets.

We don’t rely on labor-intensive sales or traditional marketing cycles. Instead, we:

- Build the valuation models that guide the luxury investment world

- Authenticate real assets through blockchain, creating trust at scale

- Set the standards for what is considered investment-grade across categories like wine, watches, handbags, and classic cars

- Provide infrastructure for ongoing resale, royalties, and price tracking—meaning every transaction becomes part of a larger data system that compounds over time

We are not merely participants in the luxury market. We are system designers, standard setters, and structural creators.

And that’s precisely where the future value lies.

Toward a New Economic Framework

It’s time to move beyond Adam Smith’s triad. The modern economy is governed by a new architecture of value—one that rewards:

- Builders of platforms

- Designers of protocols

- Owners of trust and attention

- Curators of culture

- Architects of new financial and digital systems

In this world, value is less about what you do, and more about what you set in motion.

A New Philosophy of Wealth

At MUSE, we believe that luxury is no longer just about possession. It’s about legacy, liquidity, and leverage.

And value is no longer about how many hours you work—it’s about how many systems you control, how many networks you influence, and how many people your vision empowers.

The AI era is calling for a new kind of economic thinker. One who doesn’t just work within the system—but builds it.

Are you one of them?